March 21, 2013

LINCOLN, Neb. — Despite an extreme drought and indicators of weaker agricultural earnings on the horizon, Nebraska's agricultural land markets remain strong, with an overall increase of 25 percent in the last year, according to preliminary findings from the University of Nebraska-Lincoln.

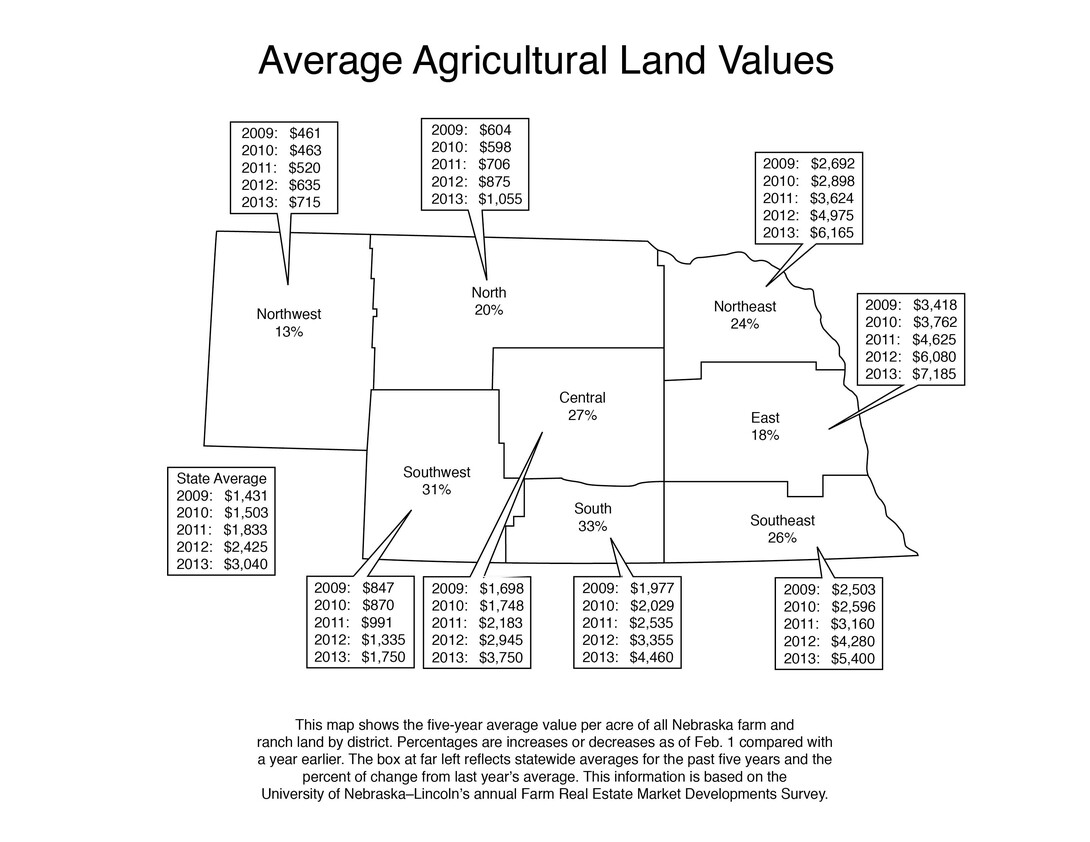

Following the advances of 22 and 32 percent in the previous two years, the 2013 all-land value of $3,040 per acre is more than double the value in early 2010.

"Few would disagree that this period has clearly been a land boom," said UNL agricultural economist Bruce Johnson, who leads the annual Nebraska Farm Real Estate Market Developments survey.

Survey reporters across the state reported percentage gains for all the farmland classes for the period from Feb. 1, 2012 to Feb. 1, 2013, but "the variation across the classes as well as across sub-state regions was extreme," Johnson said.

Drought conditions in 2012 lifted market demand for irrigated cropland, Johnson said, as irrigated land classes had the largest percentage value gains across the state.

"Income flows from irrigated land have been phenomenal in recent years, and 2012 was no exception," he said. "The combination of favorable irrigated yields while widespread drought was seen across the nation's Corn Belt fueled high crop commodity prices."

In the southern parts of Nebraska (Southwest, South, and Southeast districts) the percentage value advances for irrigated land were particularly strong over the past year.

For dryland cropland values, the percentage increases over the past year varied greatly across the state. In the Northwest and North districts, the value gains were below 10 percent, while reported values were more than 30 percent higher in the South and Southeast districts. The land class, dryland cropland with irrigation potential, shows considerable variation as well. The presence of water moratoriums across much of the state precludes irrigation development even if groundwater sources exist.

Despite the heavy toll of drought that cut forage capacity as much as 50 percent or more during the 2012 grazing season, grazing land value values still rose, Johnson said.

"Forage shortfalls for cattlemen may have actually caused a more spirited bidding for additional land just to maintain their cow herd numbers," he added. "Unfortunately, even if the drought ends quickly, it may be several years before grazing capacity may be able to return to pre-drought levels."

Survey reporters "frequently commented that current land prices being paid seem over-optimistic," Johnson said. "In turn, when asked what they expected land value movements to be for the remainder of 2013 as well as out three to five years, the vast majority saw a market which had topped out with little if any upward movement in the near future.

"In fact, a sizable number of reporters thought values could weaken somewhat in the next few years," he added.

Survey reporters also indicated that 2013 cash rental rates for cropland were up from 2012 levels. Preliminary estimates for dryland cropland cash rents in eastern Nebraska averaged about 8 percent above a year ago, while rates in the rest of the state rose 5 percent or less. The increase was much below the annual rises of the past few years, reflecting the seriousness of soil moisture deficits going into the 2013 crop year.

Across the state, center pivot irrigated cropland cash rental rates for 2013 were reportedly 13 to 15 percent above a year earlier. Reported rates for the high-third quality center pivot cropland were over $400 per acre across the eastern third of the state. The value of water in rain-deficit periods, particularly with the efficiency of the center pivot technology, is clearly being reflected in these rates.

Pasture land rates on a per-acre basis moved upward for 2013 in most regions of the state. Last year's forage production shortfalls with depleted carry-over stocks into this year have sharpened the market for pasture, even though the potential grazing output will very likely be below normal for the year. On a cow-calf pair per month basis, the rates were up from a year earlier in all regions with most districts showing gains in the 3 to 6 percent range.

Comparing the recent percentage gains in value of agricultural land classes with the associated lower percentage gains in cash rental rates indicate a continuing pattern of lower rent-to-value ratios associated with all farmland classes, Johnson said.

"At some point, the implied economic returns to land as a percent of value can fall to a point where market participants say 'enough' and no longer bid values higher," he said. "Here in Nebraska, we well may be quickly approaching that point."

The findings in this report are preliminary. A final report will be released this summer.

More information, including tables showing details of average land values for all classes of land, is at www.agecon.unl.edu. Click on the March 21 Cornhusker Economics.

Bruce Johnson, Ph.D.Professor

Agricultural Economics

402-472-1794

bjohnson2@unl.edu Dan Moser

IANR News Service

402-472-3030

dmoser3@unl.edu